ADRs make it easy to invest in Japanese stocks, even if you don't live in Japan. Learn more about ADRs and how to find undervalued stocks today!

Saturday, March 23, 2024

Ajinomoto (AJINY)-Beauty in a Bowl: How Ajinomoto Captivates Celebrities and Investors Alike

Ajinomoto (AJINY)-Beauty in a Bowl: How Ajinomoto Captivates Celebrities and Investors Alike

Ajinomoto (AJINY)

Celebrity Endorsements: A Seal of Approval

Ajinomoto's miso soup is popular among beauty-conscious celebrities due to its low calorie content and high nutritional value.

Miranda Kerr (Australian Supermodel): Known for her commitment to a healthy lifestyle, Miranda Kerr starts every morning with miso soup, praising its high nutritional value and ease of digestion. Her go-to recipe includes simple, wholesome ingredients like tofu and seaweed.

Alicia Silverstone (American Actress): As a staunch vegan and advocate for healthy living, Alicia Silverstone views miso soup as a superfood. She often enjoys it for breakfast, accompanied by warm vegetables, and loves to experiment with various types of miso and ingredients.

Anne Hathaway (American Actress): To prepare for her role as Catwoman in "The Dark Knight Rises," Anne Hathaway reportedly added miso soup to her diet as a nutritious, low-calorie option for both breakfast and lunch.

Kylie Jenner (American Reality Star): A fervent admirer of miso soup, Kylie Jenner is known to order "liters" of it from her favorite local Japanese restaurant.

Lady Gaga (American Singer): Lady Gaga, another fan of miso soup, reportedly began making it at home after developing a taste for it during a tour stop in Japan.

Monday, February 12, 2024

ORIX Corporation (IX) Outstanding Earnings - The Hidden Charm Behind Its High Price

ORIX Corporation (IX) Outstanding Earnings - The Hidden Charm Behind Its High Price

ORIX Corporation (IX)

ORIX Corporation (IX) is listed on the NYSE, with its price delayed and quoted in USD. This Japanese company operates in a wide range of financial services, illustrating a multifaceted approach to its business model. This article focuses on the movements within the Tokyo Stock Exchange, where ORIX can be found under the ticker symbol IX on the NYSE and security code 8591 on the Tokyo Exchange.

Let's dive into the latest news.

ORIX's Q3 earnings for the fiscal year ending March 2024 reported increased revenue and profits, marking a successful quarter.

Had you invested in 100 shares a year ago, here’s what it would look like now:

- Exchange Rate USD/JPY: 149

- Share Price on 2023/02/08: ¥2331 (approx. $15.64 per share)

- Share Price on 2024/02/09: ¥3010 (approx. $20.20 per share)

This translates to a return of approximately 29.13%, with a profit of about ¥67,900 from an initial investment of ¥233,100, amounting to a current total of ¥301,000. The positive reception of the financial results has been a boon for long-term holders, encouraging steady accumulation for consistent investors and presenting an opportune moment for short-term traders focused on price fluctuations.

Following the earnings announcement on February 7, 2024, the stock price appreciated, with trading on February 8 reaching highs of ¥3023.0 and lows of ¥2901.0 before closing near its peak. This activity indicates a heightened demand for ORIX shares among market participants, suggesting a positive outlook on the company's future growth and performance.

Credit trading details show a slight decrease in short positions and a significant increase in long positions, indicating a positive market sentiment and heightened expectations for stock price appreciation. Despite the high share price, PBR (Price to Book Ratio) suggests that the stock is undervalued. With a PER (Price to Earnings Ratio) of 10.56 and PBR of 0.93, these metrics suggest ORIX's stock is at an attractive valuation level for investors. The low lending and borrowing rates further enhance its appeal.

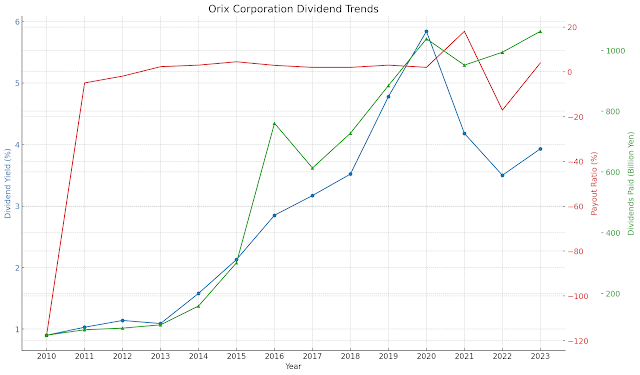

Looking at the dividend trends

ORIX has maintained a stable and increasing dividend payout, with the dividend yield fluctuating between 0.9% to 3.93% from 2010 to 2023. The company's diverse revenue streams, high profitability segments, identification of growth opportunities, balanced portfolio, and geographic diversity position it as a compelling investment opportunity.

ORIX's financial indicators, including a higher profit growth rate than industry averages, highlight its competitive edge within the financial sector. However, its relatively low expected PER suggests potential undervaluation in the market, making it an attractive proposition for value investors. ORIX's well-managed and culturally strong organization is poised for sustained profit growth, making it a suitable long-term investment.

Conclusion

ORIX stands out in the financial industry for its profitability, continuous growth, and market valuation. Its diversified business portfolio and strategic growth initiatives offer attractive elements for value investors, including an undervalued stock price, high dividend orientation, and stable payouts. These factors, combined with ORIX's excellent management and corporate culture, make its stock a compelling investment option. It's crucial to remember that investing involves risks and should be undertaken with personal responsibility and risk management in mind.

This analysis is intended to delve deeper into the attractiveness of individual stocks, not as investment recommendations.

Tuesday, January 30, 2024

The Quest for High Dividend Stocks: Unveiling the Appeal of ENEL CHILE SA (ENIC) on the NYSE - A Hidden Gem in the Global South

The Quest for High Dividend Stocks: Unveiling the Appeal of ENEL CHILE SA (ENIC) on the NYSE - A Hidden Gem in the Global South

Let's delve into the ADR market figures.

Here, we present an unusual comparison focusing on "ADRs with similar trading volumes." We've juxtaposed SONY, from an entirely different sector, for a unique perspective.| ■ADR | |||||||||

| market | ticker | Price | eps | pe | volume | marketcap | volumeavg | change | shares |

| NYSE: | ENIC | 2.84 | 1.07 | 2.66 | 462165 | 3997396439 | 715946 | -0.11 | 1383331200 |

| NYSE: | SONY | 98.56 | 7.81 | 13.57 | 405812 | 18256333200000 | 710006 | -0.33 | 1261059000 |

ADR Market Trends and Rising Interest in High Dividend Stocks:

With the launch of the new NISA in Japan, an increase in individual investors is expected, leading to growing interest in individual stocks. X (formerly Twitter) highlighted high-dividend energy sector stocks like PBR, EC during the US interest rate hikes. Shipping stocks like ZIM have navigated from high dividends to no dividends, underlining geopolitical risks and political situations, yet a strong comeback is anticipated. Continued exploration and selection of global stocks available through ADRs are planned.

Why ENEL was chosen:

Petrobras (PBR) and Ecopetrol S.A. (EC) are well-known, hence the focus on another stock. Rakuten Securities offers "related stocks" based on viewing habits, where "Enel Chile S.A. (ENIC)" caught attention. A simple yet powerful marketing method, but curiosity is always key.Tuesday, January 23, 2024

KDDIY: Uncovering the Investment Appeal Through Current Data Analysis

KDDIY: Uncovering the Investment Appeal Through Current Data Analysis

Starting with the Tokyo Stock Exchange

KDDI corp.

Ticker simbol on ADR is KDDIY.

KDDIY exhibits a stable trend, marked by a golden cross. As of January 22, 2014, the closing price stands at 5,070 yen, indicating an update in the high price. The current state, with a credit ratio below 1.0, suggests a potential short squeeze due to the excess of short selling, anticipating future buybacks.

Next, let's look at the ADR.

the Other OTC Delayed Price in USD is $17.02.

KDDIY at a Glance

Understanding the Company and Its Operations

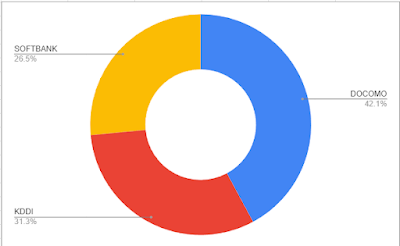

KDDIY, known as ticker symbol 9433 on the Tokyo Stock Exchange, is a leading comprehensive communication company in Japan. Its operations span mobile and fiber optic services, with an ongoing transition towards a life design company. Founded by Kazuo Inamori, who also established Kyocera, KDDIY holds a robust position as Japan's No. 2 mobile carrier with market shares as of September 30, 2023: DOCOMO (41%), KDDI (30.50%), SOFTBANK (25.80%).

A Record of Consistent Dividend Growth: Why It Matters for Investors

Trends in Stock Prices: Analyzing Past and Present Movements

A long-term view of the stock chart shows a gradual but consistent upward trend. Despite governmental pressure to reduce mobile charges, KDDIY's stock price remains resilient.

Decoding the Indicators: A Deep Dive into KDDIY's Financial Metrics

Let's examine the indicators on the Tokyo Stock Exchange.

The PE ratio stands at 15.34,

while the ADR's PE ratio as of October 12, 2023, is 13.69, maintaining a reasonable level.

The EPS on the Tokyo Stock Exchange is 310.25 yen (current exchange rate: around 148 yen to 1 USD), and the ADR's EPS (TTM) is 1.08.

Higher EPS generally leads to an increase in stock prices.

The PBR of 2.05 on the Tokyo Stock Exchange may seem a bit high, indicating a psychological inclination towards buying undervalued stocks.

Dividend Yield

The forecasted dividend yield of 2.84% is an attractive aspect for long-term investors focused on dividends.

Eight Key Attractions of KDDIY

Finally, let's summarize the eight key attractions of KDDIY:

1.Japan's No. 2 mobile carrier.

2.Leading share in 5G services in Japan as of March 2023.

3.Expanding 'au PAY' payment services.

4.Providing entertainment services like 'au Smart Pass'.

5.Growing overseas business, especially in Asia.

6.Strong financial foundation with a solid equity ratio.

7.Efficient management and cost-cutting expertise.

8.Demonstrated stable management with continuous growth over the past decade.

This article aims to analyze and is not an endorsement of individual stocks.

Investment decisions should be made at your own risk.

Friday, January 19, 2024

Looking for a Continuously Increasing Dividend Stock? Let's Decode the Numbers Behind KDDIY

Looking for a Continuously Increasing Dividend Stock? Let's Decode the Numbers Behind KDDIY

About KDDIY

RRecaro Porsche Gaming Chair Brand New Limited Edition RRP £1706.00

KDDIY is one of Japan's major comprehensive telecommunications companies, offering mobile and fiber optic services. Currently, the company is expanding into non-telecommunication areas such as retail. It is exploring a transformation into a life design company and is performing well in both financial and corporate sectors, having achieved record net profits. KDDIY is on a trend of increasing dividends. For the fiscal year ending March 2025, it continued to see an increase in profits due to rising communication charges. In October 2023, KDDIY started collaborating with AWS to support AI development. The focus is shifting towards expanding metaverse content and adopting a business model that combines their own products with AI services from supported companies.

Why This Stock is Worth Attention

US 360 Rotation Car Rear View Mirror Mount Stand GPS Cell Phone Holder wholesale

Let's look at the market share within Japan.

As of September 30, 2023:

- NTTYY: 41%

- KDDIY: 30.50%

- SOBKY: 25.80%

KDDIY ranks second domestically. Next, let's examine the PBR (Price Book-value Ratio). Comparing PBR with rivals:

- NTTYY: 1.86 times

- KDDIY: 2.10 times

- SOBKY: 4.14 times

A lower PBR indicates a more undervalued stock price. KDDIY is the second most undervalued according to this metric. The Tokyo Stock Exchange has started demanding improvements from companies with a PBR below 1.0.

Now, let's discuss dividends, everyone's favorite topic:

- NTTYY: 2.67%

- KDDIY: 2.8%

- SOBKY: 4.42%

Domestic Reputation

Vuzix M300XL 2 Unit Value Bundle with Accessories

KDDIY is known as a continuously increasing dividend company.

It has a history of increasing dividends for 21 years and ranks 9th among the top 10 companies in Japan's continuous dividend ranking. Hence, it is preferred by Japanese individual investors for long-term portfolios.

Stock Chart The stock price is at $16.88. The chart shows a gradual upward trend with minor fluctuations.

KDDIY's Business Performance and Reputation KDDIY was recognized with a 5-star rating in the "7th Nikkei Smart Work Management Survey" (November 2023), marking its fourth consecutive year. This survey by Nikkei Inc., started in 2017, targets listed and major unlisted companies nationwide. It defines "Smart Work Management" as efforts to maximize organizational performance through diverse and flexible working styles, innovative business creation, and market development, including management foundations. Out of 834 companies surveyed, KDDIY received high marks in "Innovation" and "Market Development."

Is It an Attractive Investment? The current stock price level may not seem undervalued in terms of PBR and PER, but buying stocks of companies that have achieved continuous dividend growth at a reasonable price is a hallmark of value investing. It can be enjoyable to watch the market movements for a while, searching for the right moment to invest.

Recent News Trends There has been news that could influence short-term market movements. Trading of the Huaxia Nomura Nikkei 225 ETF, listed on the Shanghai market, was temporarily suspended on the 17th. It appears that the influx of funds into Japanese stocks in the Shanghai market led to this temporary suspension due to overheating popularity. This news can be seen on Reuters at Reuters link.

For active funds, it's becoming increasingly challenging to outperform indices in the Chinese market, and there's a perspective that passive investment might hold a greater advantage. However, for investors who favor active funds, this may seem like a moment to rally behind them.

Trends in Japan In Japan, shareholders who reside in the country have access to a unique shareholder benefits program. Previously, these benefits included catalog gifts that allowed for shopping, but starting from 2025, shareholders will have the option to choose from specific services such as AuPay Market, convenience stores, or points usable online.

This change is likely to appeal to individual investors who prefer long-term investments, as it enhances the value of holding shares by offering more flexible and practical rewards.

My Perspective I am a supporter of the global economy and believe in sending encouragement to those managing active funds, even in challenging times. The investment world is complex, and there are always opportunities for different strategies to thrive. In this evolving landscape, supporting diverse investment approaches is essential.

"Interested in exploring more about KDDIY's broader investment potential? Be sure to check out our detailed exploration in 'KDDIY: Uncovering the Investment Appeal Through Current Data Analysis.' In this article, we delve deeper into what makes KDDIY a compelling option for investors, from market trends to strategic operations. [Continue Reading]

About Me

- IchikabuImpact

- 大衆心理やその裏側を分析しています。 不思議でしょうがない小型株。 非常に買いにくく恥ずかしい馬券。 常識では見抜くことのできない世界観と 答えがない世界に飛び込み魅惑のネタを探求していきます