ADRs make it easy to invest in Japanese stocks, even if you don't live in Japan. Learn more about ADRs and how to find undervalued stocks today!

Monday, February 12, 2024

ORIX Corporation (IX) Outstanding Earnings - The Hidden Charm Behind Its High Price

ORIX Corporation (IX) Outstanding Earnings - The Hidden Charm Behind Its High Price

ORIX Corporation (IX)

ORIX Corporation (IX) is listed on the NYSE, with its price delayed and quoted in USD. This Japanese company operates in a wide range of financial services, illustrating a multifaceted approach to its business model. This article focuses on the movements within the Tokyo Stock Exchange, where ORIX can be found under the ticker symbol IX on the NYSE and security code 8591 on the Tokyo Exchange.

Let's dive into the latest news.

ORIX's Q3 earnings for the fiscal year ending March 2024 reported increased revenue and profits, marking a successful quarter.

Had you invested in 100 shares a year ago, here’s what it would look like now:

- Exchange Rate USD/JPY: 149

- Share Price on 2023/02/08: ¥2331 (approx. $15.64 per share)

- Share Price on 2024/02/09: ¥3010 (approx. $20.20 per share)

This translates to a return of approximately 29.13%, with a profit of about ¥67,900 from an initial investment of ¥233,100, amounting to a current total of ¥301,000. The positive reception of the financial results has been a boon for long-term holders, encouraging steady accumulation for consistent investors and presenting an opportune moment for short-term traders focused on price fluctuations.

Following the earnings announcement on February 7, 2024, the stock price appreciated, with trading on February 8 reaching highs of ¥3023.0 and lows of ¥2901.0 before closing near its peak. This activity indicates a heightened demand for ORIX shares among market participants, suggesting a positive outlook on the company's future growth and performance.

Credit trading details show a slight decrease in short positions and a significant increase in long positions, indicating a positive market sentiment and heightened expectations for stock price appreciation. Despite the high share price, PBR (Price to Book Ratio) suggests that the stock is undervalued. With a PER (Price to Earnings Ratio) of 10.56 and PBR of 0.93, these metrics suggest ORIX's stock is at an attractive valuation level for investors. The low lending and borrowing rates further enhance its appeal.

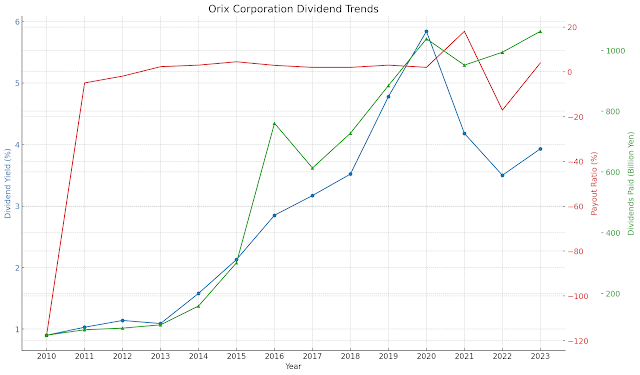

Looking at the dividend trends

ORIX has maintained a stable and increasing dividend payout, with the dividend yield fluctuating between 0.9% to 3.93% from 2010 to 2023. The company's diverse revenue streams, high profitability segments, identification of growth opportunities, balanced portfolio, and geographic diversity position it as a compelling investment opportunity.

ORIX's financial indicators, including a higher profit growth rate than industry averages, highlight its competitive edge within the financial sector. However, its relatively low expected PER suggests potential undervaluation in the market, making it an attractive proposition for value investors. ORIX's well-managed and culturally strong organization is poised for sustained profit growth, making it a suitable long-term investment.

Conclusion

ORIX stands out in the financial industry for its profitability, continuous growth, and market valuation. Its diversified business portfolio and strategic growth initiatives offer attractive elements for value investors, including an undervalued stock price, high dividend orientation, and stable payouts. These factors, combined with ORIX's excellent management and corporate culture, make its stock a compelling investment option. It's crucial to remember that investing involves risks and should be undertaken with personal responsibility and risk management in mind.

This analysis is intended to delve deeper into the attractiveness of individual stocks, not as investment recommendations.

About Me

- IchikabuImpact

- 大衆心理やその裏側を分析しています。 不思議でしょうがない小型株。 非常に買いにくく恥ずかしい馬券。 常識では見抜くことのできない世界観と 答えがない世界に飛び込み魅惑のネタを探求していきます