KDDIY: Uncovering the Investment Appeal Through Current Data Analysis

Starting with the Tokyo Stock Exchange

KDDI corp.

Ticker simbol on ADR is KDDIY.

KDDIY exhibits a stable trend, marked by a golden cross. As of January 22, 2014, the closing price stands at 5,070 yen, indicating an update in the high price. The current state, with a credit ratio below 1.0, suggests a potential short squeeze due to the excess of short selling, anticipating future buybacks.

Next, let's look at the ADR.

the Other OTC Delayed Price in USD is $17.02.

KDDIY at a Glance

Understanding the Company and Its Operations

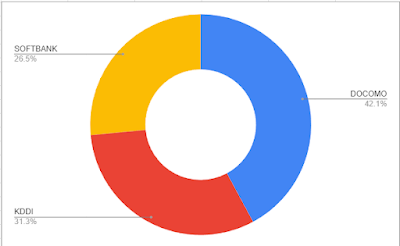

KDDIY, known as ticker symbol 9433 on the Tokyo Stock Exchange, is a leading comprehensive communication company in Japan. Its operations span mobile and fiber optic services, with an ongoing transition towards a life design company. Founded by Kazuo Inamori, who also established Kyocera, KDDIY holds a robust position as Japan's No. 2 mobile carrier with market shares as of September 30, 2023: DOCOMO (41%), KDDI (30.50%), SOFTBANK (25.80%).

A Record of Consistent Dividend Growth: Why It Matters for Investors

Trends in Stock Prices: Analyzing Past and Present Movements

A long-term view of the stock chart shows a gradual but consistent upward trend. Despite governmental pressure to reduce mobile charges, KDDIY's stock price remains resilient.

Decoding the Indicators: A Deep Dive into KDDIY's Financial Metrics

Let's examine the indicators on the Tokyo Stock Exchange.

The PE ratio stands at 15.34,

while the ADR's PE ratio as of October 12, 2023, is 13.69, maintaining a reasonable level.

The EPS on the Tokyo Stock Exchange is 310.25 yen (current exchange rate: around 148 yen to 1 USD), and the ADR's EPS (TTM) is 1.08.

Higher EPS generally leads to an increase in stock prices.

The PBR of 2.05 on the Tokyo Stock Exchange may seem a bit high, indicating a psychological inclination towards buying undervalued stocks.

Dividend Yield

The forecasted dividend yield of 2.84% is an attractive aspect for long-term investors focused on dividends.

Eight Key Attractions of KDDIY

Finally, let's summarize the eight key attractions of KDDIY:

1.Japan's No. 2 mobile carrier.

2.Leading share in 5G services in Japan as of March 2023.

3.Expanding 'au PAY' payment services.

4.Providing entertainment services like 'au Smart Pass'.

5.Growing overseas business, especially in Asia.

6.Strong financial foundation with a solid equity ratio.

7.Efficient management and cost-cutting expertise.

8.Demonstrated stable management with continuous growth over the past decade.

This article aims to analyze and is not an endorsement of individual stocks.

Investment decisions should be made at your own risk.

Post a Comment