ADRs make it easy to invest in Japanese stocks, even if you don't live in Japan. Learn more about ADRs and how to find undervalued stocks today!

Sunday, May 12, 2024

Attracting an 18.3% Dividend Yield: The Allure of LOMA – Loma Negra Compañía Industrial Argentina and Its Commitment to Sustainability

Attracting an 18.3% Dividend Yield: The Allure of LOMA – Loma Negra Compañía Industrial Argentina and Its Commitment to Sustainability

Conclusion: Despite Argentina's hyperinflation, the country holds firm. Please enjoy the read till the end. Here are some points that remained unclear:

- The reason behind the exceptionally high dividend yield.

- The reasons behind the optimistic revenue forecast for fiscal 2024, and why the Earnings Per Share (EPS) is a negative 285.08.

Background: The dividend yield of 18.13% piqued my curiosity.

Loma Negra Compañía Industrial Argentina is a vertically integrated company based in Argentina, active in the cement industry. It is listed on the NYSE under the ticker symbol LOMA. Let’s explore its history:

- 1926: Alfredo Fortabat discovers a large limestone deposit at San Jacinto Estancia and decides to establish a cement plant in the village of Pampas.

- 1927-1950: The facility, along with another in Barker nearby, produces 500,000 tons of cement annually.

- 1960s: New facilities open in San Juan and Zapala, making Loma Negra a leader in Argentina's cement and concrete production.

- 1980s: The first Portland cement facility opens in another Andean city, Catamarca.

- 1976: Maria Amalia Lacroze de Fortabat becomes the company's main shareholder, president, and chairman.

- 1992: Acquires competitor Cementos San Martin SA, strengthening its market leadership.

- 1995: Launches Recycomb.

- 1998-1999: Acquires five concrete manufacturing companies.

- 1999: Establishes the Loma Negra Technical Center.

- 2007-2008: Maintains a 48% market share.

A graph highlights the significant trend in December 2024, showing very optimistic sales forecasts and negative EPS.

Cash Flow Analysis:

From 2020 to 2022, there is a steady increase in operating cash flow—a positive indicator of sound management. Recent years show negative financial cash flow, suggesting that fundraising costs exceed new debt and equity issuance. The financial strategy might maintain investor confidence through dividends, despite expected losses, but this remains unclear.

Sand Shortage and Recycling Initiatives:

There is a reported shortage of sand compared to its consumption, which the United Nations warned about in May 2022. Loma Negra’s recycling efforts add value, particularly in cement and construction materials production. Here are some specific recycling initiatives undertaken:

- Alternative Raw Materials and Fuels: Incorporating recycled materials and alternative fuels into the manufacturing process, including using industrial by-products like fly ash and slag from steel manufacturing, reducing waste and minimizing environmental impact.

- Energy Efficiency: Focusing on improving energy efficiency across all operations, including optimizing energy use in production processes and investing in technology to reduce energy consumption.

- CO2 Emission Reduction: Integrating recycled materials and alternative fuels to reduce carbon emissions associated with cement production, part of a broader industry trend towards global sustainability goals.

- Community Recycling Efforts: Engaging in community-based recycling programs, which not only help manage waste but also educate the community on the benefits of recycling and sustainable practices.

- Water Conservation: Minimizing water use in manufacturing processes and enhancing water efficiency through recycling and reduction strategies, reflecting efforts to reduce the environmental footprint of business operations and potentially leading to long-term economic savings and improving the company’s reputation among environmentally conscious stakeholders.

Sustainability Report 2023: Loma Negra publishes a sustainability report on its portal site, detailing its commitment to sustainable development and leadership, the dedication and innovation of its workforce, and its engagement with communities to transform and improve lives globally. The report addresses major environmental and climate issues, striving for carbon neutrality and emphasizing overall environmental consideration.

Why the High Dividend?

- The 18.13% dividend yield is indeed an eye-catching figure, appealing strongly to public interest.

- Optimistic Financial Forecasts: Financial projections up to 2025 show aggressive revenue growth, with profits expected to recover after substantial losses forecasted for 2024. This optimism may be based on improved operational efficiency, expansion of market scope, or introduction of new products.

- Historical Dividend Policy: The reasons behind the high dividend yield, especially in years when losses are anticipated, are not immediately apparent from the provided data. However, possible explanations include:

- High dividends could be a strategy to maintain investor confidence and attract new shareholders, especially in unstable markets. The company may wish to highlight its financial health and commitment to returning value to investors.

- Some firms adopt a policy of maintaining or gradually increasing dividends as a sign of stability and reliability, which may be independent of short-term earnings fluctuations

Saturday, March 23, 2024

Ajinomoto (AJINY)-Beauty in a Bowl: How Ajinomoto Captivates Celebrities and Investors Alike

Ajinomoto (AJINY)-Beauty in a Bowl: How Ajinomoto Captivates Celebrities and Investors Alike

Ajinomoto (AJINY)

Celebrity Endorsements: A Seal of Approval

Ajinomoto's miso soup is popular among beauty-conscious celebrities due to its low calorie content and high nutritional value.

Miranda Kerr (Australian Supermodel): Known for her commitment to a healthy lifestyle, Miranda Kerr starts every morning with miso soup, praising its high nutritional value and ease of digestion. Her go-to recipe includes simple, wholesome ingredients like tofu and seaweed.

Alicia Silverstone (American Actress): As a staunch vegan and advocate for healthy living, Alicia Silverstone views miso soup as a superfood. She often enjoys it for breakfast, accompanied by warm vegetables, and loves to experiment with various types of miso and ingredients.

Anne Hathaway (American Actress): To prepare for her role as Catwoman in "The Dark Knight Rises," Anne Hathaway reportedly added miso soup to her diet as a nutritious, low-calorie option for both breakfast and lunch.

Kylie Jenner (American Reality Star): A fervent admirer of miso soup, Kylie Jenner is known to order "liters" of it from her favorite local Japanese restaurant.

Lady Gaga (American Singer): Lady Gaga, another fan of miso soup, reportedly began making it at home after developing a taste for it during a tour stop in Japan.

Monday, February 12, 2024

ORIX Corporation (IX) Outstanding Earnings - The Hidden Charm Behind Its High Price

ORIX Corporation (IX) Outstanding Earnings - The Hidden Charm Behind Its High Price

ORIX Corporation (IX)

ORIX Corporation (IX) is listed on the NYSE, with its price delayed and quoted in USD. This Japanese company operates in a wide range of financial services, illustrating a multifaceted approach to its business model. This article focuses on the movements within the Tokyo Stock Exchange, where ORIX can be found under the ticker symbol IX on the NYSE and security code 8591 on the Tokyo Exchange.

Let's dive into the latest news.

ORIX's Q3 earnings for the fiscal year ending March 2024 reported increased revenue and profits, marking a successful quarter.

Had you invested in 100 shares a year ago, here’s what it would look like now:

- Exchange Rate USD/JPY: 149

- Share Price on 2023/02/08: ¥2331 (approx. $15.64 per share)

- Share Price on 2024/02/09: ¥3010 (approx. $20.20 per share)

This translates to a return of approximately 29.13%, with a profit of about ¥67,900 from an initial investment of ¥233,100, amounting to a current total of ¥301,000. The positive reception of the financial results has been a boon for long-term holders, encouraging steady accumulation for consistent investors and presenting an opportune moment for short-term traders focused on price fluctuations.

Following the earnings announcement on February 7, 2024, the stock price appreciated, with trading on February 8 reaching highs of ¥3023.0 and lows of ¥2901.0 before closing near its peak. This activity indicates a heightened demand for ORIX shares among market participants, suggesting a positive outlook on the company's future growth and performance.

Credit trading details show a slight decrease in short positions and a significant increase in long positions, indicating a positive market sentiment and heightened expectations for stock price appreciation. Despite the high share price, PBR (Price to Book Ratio) suggests that the stock is undervalued. With a PER (Price to Earnings Ratio) of 10.56 and PBR of 0.93, these metrics suggest ORIX's stock is at an attractive valuation level for investors. The low lending and borrowing rates further enhance its appeal.

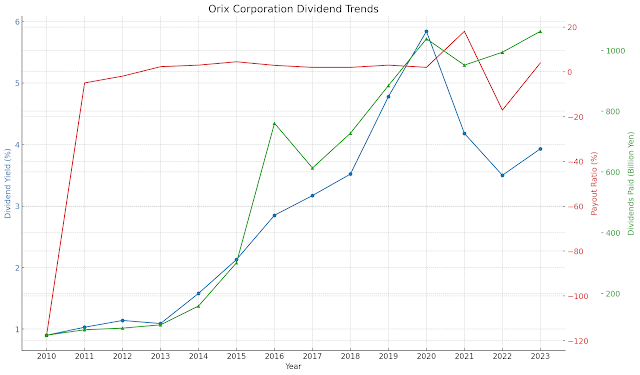

Looking at the dividend trends

ORIX has maintained a stable and increasing dividend payout, with the dividend yield fluctuating between 0.9% to 3.93% from 2010 to 2023. The company's diverse revenue streams, high profitability segments, identification of growth opportunities, balanced portfolio, and geographic diversity position it as a compelling investment opportunity.

ORIX's financial indicators, including a higher profit growth rate than industry averages, highlight its competitive edge within the financial sector. However, its relatively low expected PER suggests potential undervaluation in the market, making it an attractive proposition for value investors. ORIX's well-managed and culturally strong organization is poised for sustained profit growth, making it a suitable long-term investment.

Conclusion

ORIX stands out in the financial industry for its profitability, continuous growth, and market valuation. Its diversified business portfolio and strategic growth initiatives offer attractive elements for value investors, including an undervalued stock price, high dividend orientation, and stable payouts. These factors, combined with ORIX's excellent management and corporate culture, make its stock a compelling investment option. It's crucial to remember that investing involves risks and should be undertaken with personal responsibility and risk management in mind.

This analysis is intended to delve deeper into the attractiveness of individual stocks, not as investment recommendations.

Tuesday, January 30, 2024

The Quest for High Dividend Stocks: Unveiling the Appeal of ENEL CHILE SA (ENIC) on the NYSE - A Hidden Gem in the Global South

The Quest for High Dividend Stocks: Unveiling the Appeal of ENEL CHILE SA (ENIC) on the NYSE - A Hidden Gem in the Global South

Let's delve into the ADR market figures.

Here, we present an unusual comparison focusing on "ADRs with similar trading volumes." We've juxtaposed SONY, from an entirely different sector, for a unique perspective.| ■ADR | |||||||||

| market | ticker | Price | eps | pe | volume | marketcap | volumeavg | change | shares |

| NYSE: | ENIC | 2.84 | 1.07 | 2.66 | 462165 | 3997396439 | 715946 | -0.11 | 1383331200 |

| NYSE: | SONY | 98.56 | 7.81 | 13.57 | 405812 | 18256333200000 | 710006 | -0.33 | 1261059000 |

ADR Market Trends and Rising Interest in High Dividend Stocks:

With the launch of the new NISA in Japan, an increase in individual investors is expected, leading to growing interest in individual stocks. X (formerly Twitter) highlighted high-dividend energy sector stocks like PBR, EC during the US interest rate hikes. Shipping stocks like ZIM have navigated from high dividends to no dividends, underlining geopolitical risks and political situations, yet a strong comeback is anticipated. Continued exploration and selection of global stocks available through ADRs are planned.

Why ENEL was chosen:

Petrobras (PBR) and Ecopetrol S.A. (EC) are well-known, hence the focus on another stock. Rakuten Securities offers "related stocks" based on viewing habits, where "Enel Chile S.A. (ENIC)" caught attention. A simple yet powerful marketing method, but curiosity is always key.About Me

- IchikabuImpact

- 大衆心理やその裏側を分析しています。 不思議でしょうがない小型株。 非常に買いにくく恥ずかしい馬券。 常識では見抜くことのできない世界観と 答えがない世界に飛び込み魅惑のネタを探求していきます